Have you ever wondered why routing numbers are crucial when dealing with financial transactions? A routing number acts as a digital address that ensures your money reaches the correct bank branch. Without it, funds could easily get lost in the vast network of banking systems. In this article, we explore the intricacies of PNC Bank’s routing numbers and provide clarity on how to locate them effortlessly.

PNC Bank serves millions of customers across various states in the United States. As one of the leading financial institutions, understanding its routing system is essential for smooth transactions. Whether you're sending money domestically or internationally, knowing the right routing number can save you from unnecessary delays and fees. For instance, if you reside in Missouri, your routing number would be 071921891. Similarly, New Jersey residents should use 031207607, while North Carolina clients require 043000096. These numbers may seem arbitrary, but they play a pivotal role in directing your payments accurately.

When setting up wire transfers, providing the correct routing number becomes even more critical. If you're initiating an incoming wire transfer, ensure you supply both your account number and the appropriate PNC Bank routing number, which is 043000096. This process guarantees that your transaction will proceed without hiccups. Additionally, some institutions like Fidelity utilize separate routing numbers for wire transfers versus Automated Clearing House (ACH) transfers. Being aware of these distinctions can prevent potential issues during fund transfers.

For those residing in Glendora, New Jersey, the local PNC Bank branch offers convenient services at 900 Black Horse Pike, Glendora, NJ 08029. Customers benefit from drive-up ATM services, making banking accessible around the clock. Such amenities contribute significantly to customer satisfaction by streamlining daily banking needs.

Understanding what a routing number entails is fundamental to navigating today's complex financial landscape. Essentially, a routing number identifies the specific financial institution responsible for processing a payment. It comprises nine digits and adheres to standards set by the American Bankers Association (ABA). When executing domestic transfers within the U.S., banks rely heavily on ABA routing numbers. However, international transactions necessitate additional identifiers such as SWIFT codes.

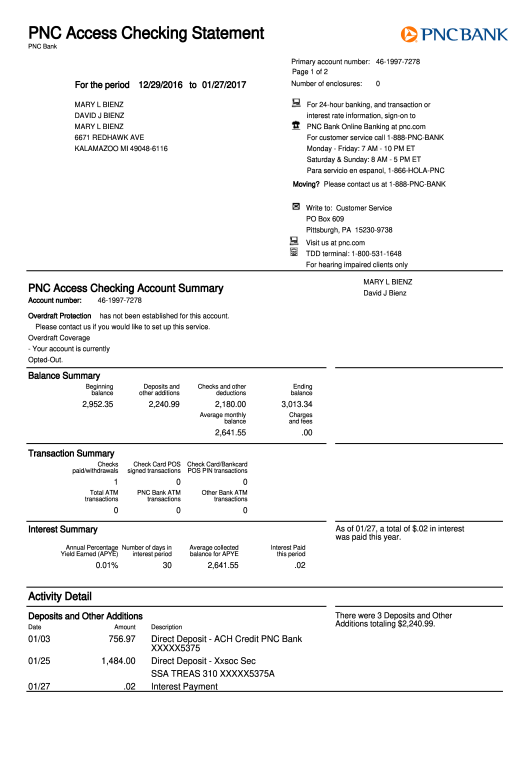

Locating your PNC routing number doesn't have to be daunting. Several methods exist to help you retrieve this vital information quickly. One straightforward approach involves examining your checks. Typically, the routing number appears at the bottom left corner of each check, followed by your individual account number and check number. Alternatively, accessing your online banking portal provides another reliable avenue for finding your routing number. Simply log into your account and navigate to the relevant section where detailed account information resides.

In certain scenarios, individuals might encounter difficulties with wire transfers not being recognized despite supplying accurate details. Such occurrences often stem from discrepancies between expected and actual routing numbers used by third-party entities. To mitigate these challenges, always verify whether the institution handling your transfer employs distinct routing numbers for different types of transactions. Moreover, consulting directly with your bank representative ensures all necessary steps are taken to resolve any anomalies swiftly.

PNC Bank's Virtual Wallet Checking accounts exemplify innovation in personal finance management. By integrating traditional checking features with cutting-edge digital tools, customers enjoy enhanced convenience and control over their finances. Features include mobile deposits, real-time alerts, and seamless integration with other PNC services. Embracing technology empowers users to manage their money effectively, regardless of location or time constraints.

As technology continues advancing, reliance on digital platforms for managing finances grows exponentially. Consequently, familiarizing oneself with key components like routing numbers remains indispensable. Not only does it facilitate efficient transactions, but it also fosters confidence in navigating modern banking systems. So next time you need to send or receive funds via PNC Bank, remember the importance of verifying the correct routing number beforehand.

To summarize, PNC Bank caters to diverse customer needs through extensive networks spanning multiple states. Each region utilizes unique routing numbers tailored specifically to their operations. Utilizing resources available either physically at branches or virtually through digital channels simplifies identifying and utilizing these numbers correctly. Furthermore, staying informed about variations among institutions regarding routing protocols helps avoid common pitfalls associated with transferring funds electronically.

With globalization driving increased interconnectivity among economies worldwide, mastering basic banking principles equips individuals better to participate actively in global commerce. Thus, arming yourself with knowledge concerning routing numbers represents just one step towards achieving financial literacy—a skill increasingly valuable in our interconnected world.