Have you ever wondered why routing numbers are crucial for banking transactions? A simple nine-digit code, the routing number serves as the backbone of financial operations across the United States. For instance, if you reside in New Jersey and bank with PNC, knowing your routing number 031207607 can streamline your payment processes significantly. This isn't just a random sequence; it's a unique identifier that ensures funds reach their intended destination without error. Whether you're setting up direct deposits or initiating wire transfers, having this information at your fingertips is essential.

PNC Bank, one of the largest financial institutions in the U.S., operates numerous branches across several states including Pennsylvania, Ohio, North Carolina, and notably, New Jersey. Each state has its designated routing number to facilitate seamless transactions within regional boundaries. In New Jersey, the specific routing number assigned to PNC Bank is 031207607. This number not only aids in automating payments but also enhances security measures by authenticating legitimate transactions. Moreover, advancements in technology have enabled services like Payment Labs to replace outdated manual payout systems with efficient automated solutions, greatly benefiting customers such as those at CueSports International (CSI).

| Name | PNC Bank |

|---|---|

| Routing Number | 031207607 |

| Location | New Jersey |

| Headquarters | Pittsburgh, PA |

| Founded | 1852 |

| Website | pnc.com |

For residents of New Jersey specifically, understanding how to locate and utilize the correct routing number becomes paramount when dealing with electronic fund transfers. The table above provides critical details about PNC Bank’s operations pertinent to individuals residing in New Jersey. It highlights the official website link where users can access further resources regarding their accounts and transactional needs. Additionally, maintaining awareness of these specifics helps prevent fraudulent activities often associated with incorrect routing numbers.

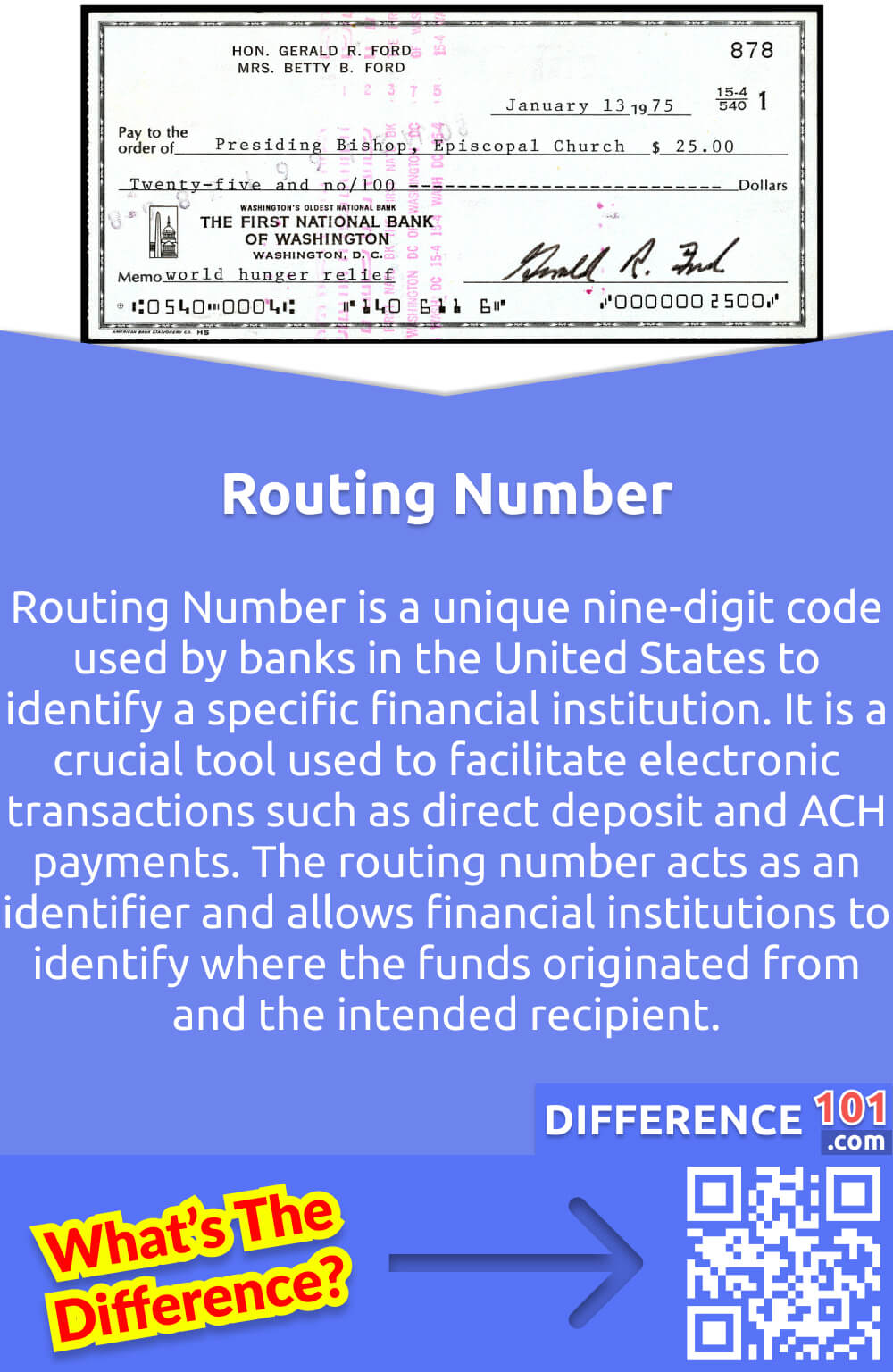

Beyond mere identification purposes, routing numbers play an instrumental role in various banking functions. They assist banks in distinguishing between different financial institutions during interbank communications. Furthermore, they contribute towards ensuring accuracy in processing checks, initiating automatic bill payments, and managing payroll distributions efficiently. Consider a scenario involving multiple payees receiving compensation through automated clearing house (ACH) transfers – each recipient requires accurate routing information attached to their account details to guarantee successful delivery of funds.

In practical terms, consider two distinct examples illustrating the importance of utilizing appropriate routing numbers: Firstly, imagine being a business owner located in Philadelphia who regularly sends invoices payable via ACH transfer to clients based out of Trenton, NJ. Utilizing the precise routing number 031207607 would ensure timely receipt of payments while minimizing potential complications arising from mismatched data entries. Secondly, envision yourself as an individual setting up recurring utility bills directly debited from your checking account at PNC Bank's branch in Haddonfield, NJ. Providing the exact routing number guarantees uninterrupted service continuity without unnecessary delays caused by erroneous input errors.

Another aspect worth noting relates to geographical distinctions among varying regions served under PNC Bank umbrella. While New Jersey employs routing number 031207607, other locations such as Ohio may use alternative codes depending upon jurisdictional requirements. Therefore, staying informed about regional variations remains equally important alongside general knowledge surrounding routing mechanisms themselves. As demonstrated earlier, even minor discrepancies could lead to significant disruptions affecting both personal finances and commercial dealings alike.

Moreover, recent innovations introduced by PNC Bank exemplify forward-thinking approaches aimed at improving customer experience. Their Virtual Wallet Checking Accounts integrate traditional banking features with cutting-edge digital tools designed to enhance convenience and accessibility. Such developments underscore the evolving nature of modern finance wherein technological integration plays pivotal roles shaping future landscapes. Consequently, consumers benefit immensely from increased flexibility afforded by such enhancements allowing them greater control over their monetary affairs.

Lastly, let us delve briefly into considerations surrounding ATM availability provided by select branches like those situated along Haddon Avenue in Haddonfield or Black Horse Pike in Glendora within New Jersey territory. These facilities offer extended service options catering specifically toward enhancing client satisfaction levels. By incorporating drive-up ATMs alongside vestibule alternatives, PNC Bank demonstrates commitment towards meeting diverse user preferences effectively. Such strategic implementations reflect broader industry trends prioritizing ease-of-use coupled with robust security protocols safeguarding sensitive financial information against unauthorized access attempts.

In conclusion, comprehending the significance behind seemingly mundane aspects like routing numbers reveals deeper insights concerning underlying complexities governing today's interconnected global economy. From facilitating everyday transactions to supporting complex corporate operations, reliable infrastructure forms foundational pillars sustaining steady progress moving forward. Thus, arming oneself with relevant knowledge equips individuals better prepared navigating increasingly intricate fiscal environments confidently.