Have you ever wondered how the intricate web of banking transactions operates seamlessly behind the scenes? A robust infrastructure supports the smooth transfer of funds, and one critical component of this system is the routing number. This nine-digit code plays a pivotal role in ensuring that your money reaches its intended destination accurately and efficiently. Without it, the entire banking ecosystem could falter. It's essential for anyone managing finances to understand what a routing number is, where to find it, and how it functions.

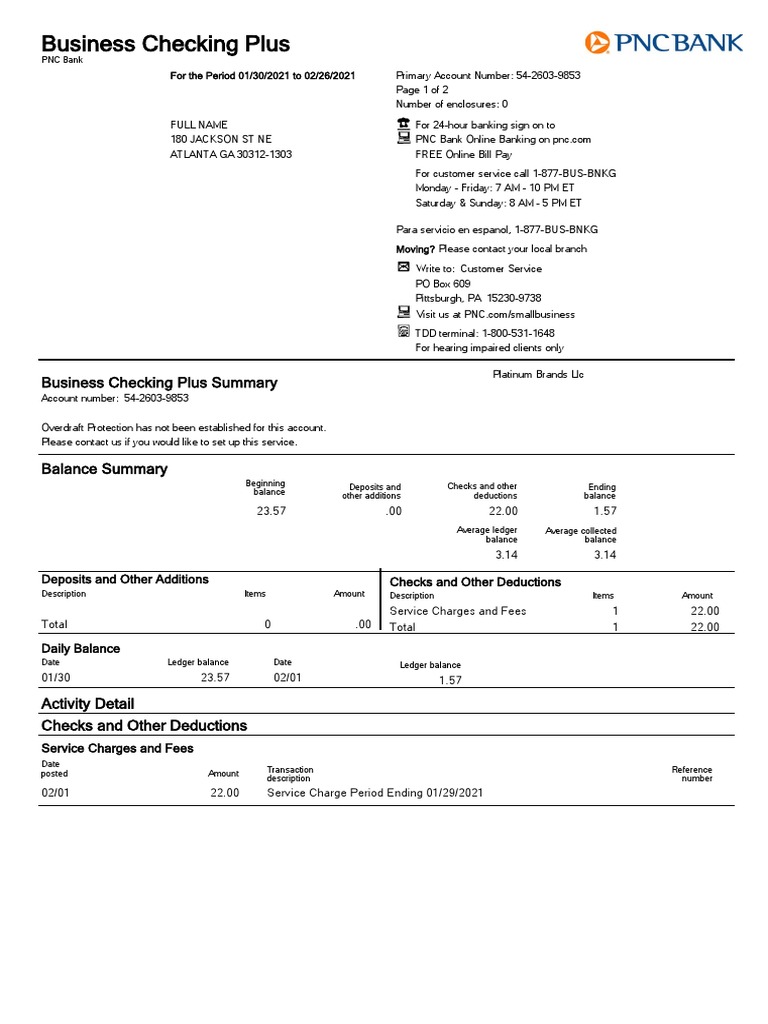

A routing number, also known as an ABA routing transit number, serves as a unique identifier for financial institutions within the United States. Its primary function is to direct funds to the correct bank during electronic transfers or check processing. Whether you're setting up direct deposits, paying bills online, or initiating wire transfers, the routing number ensures precision in these transactions. For instance, if you're affiliated with PNC Bank, knowing your specific routing number becomes indispensable when engaging in various financial activities.

| Personal Information | Details |

|---|---|

| Name | PNC Bank |

| Date Established | 1852 |

| Headquarters | Pittsburgh, Pennsylvania |

| Website | PNC Official Website |

| Career Highlights | Offers comprehensive personal and business banking services |

| Professional Achievements | Ranked among top banks in asset management and corporate finance |

PNC Bank, headquartered in Pittsburgh, Pennsylvania, has been a stalwart in the financial sector since its establishment in 1852. As one of the largest diversified financial services companies in the U.S., it provides a wide array of banking solutions tailored to meet individual and corporate needs. Among its offerings are checking and savings accounts, credit cards, mortgages, auto loans, and investment advisory services. Understanding the nuances of its operations can significantly enhance your financial literacy and empower you to make informed decisions regarding your assets.

When dealing with PNC Bank, locating your routing number is relatively straightforward. For most customers residing in different states across the country, the standard routing number remains consistent at 043000096. However, certain specialized accounts might necessitate distinct numbers depending on the nature of the transaction or geographic location. Always verify through official channels such as the PNC Mobile App or online banking portal to confirm accuracy before proceeding with any monetary exchange.

For those utilizing Automated Clearing House (ACH) transfers, adhering to precise instructions guarantees success without complications. An ACH transfer involves electronically moving funds between banks using a batch processing system managed by the Federal Reserve. At PNC Bank, the process entails providing the recipient with specific details including the bank name (PNC Bank), routing number (043000096), account number (e.g., 1069946309), and account holder's name (Pennsylvania Municipal Retirement System). Following these guidelines meticulously prevents delays and potential errors.

In addition to ACH transfers, wire transfers represent another common method employed by individuals and businesses alike for sending large sums of money domestically or internationally. Unlike ACH transfers, which typically take several days to complete due to batching procedures, wires occur almost instantaneously but often incur higher fees. Regardless of the chosen approach, maintaining accurate records of all pertinent information remains crucial throughout the procedure.

Moreover, advancements in technology have streamlined many aspects of modern banking practices, making them more accessible than ever before. Through mobile applications and web interfaces provided by institutions like PNC Bank, users gain unprecedented control over their finances right from their fingertips. Features such as real-time balance updates, transaction history reviews, bill payments scheduling, and secure messaging capabilities foster greater transparency and convenience in daily fiscal management.

Despite these conveniences, safeguarding sensitive data continues to pose challenges amidst increasing cyber threats targeting financial systems worldwide. Implementing robust security measures becomes paramount in protecting personal information against unauthorized access attempts. Practices such as creating strong passwords, enabling two-factor authentication, regularly monitoring account activity, and promptly reporting suspicious incidents contribute towards mitigating risks associated with digital banking platforms.

Furthermore, staying updated about evolving regulations governing banking operations helps consumers navigate complex landscapes effectively. Periodic revisions to policies concerning privacy rights, disclosure requirements, and permissible uses of customer data ensure compliance while promoting trust between service providers and clients. Educating oneself on these matters equips individuals with knowledge necessary to advocate for their best interests when interacting with financial entities.

In summary, mastering fundamental concepts related to routing numbers and other facets of contemporary banking empowers people to harness available tools confidently. By leveraging resources offered by reputable organizations such as PNC Bank, individuals can optimize their financial strategies and achieve long-term stability. Remember, understanding key components underpinning successful transactions not only simplifies processes but also enhances overall satisfaction derived from utilizing cutting-edge banking technologies responsibly.

| State | PNC Routing Number |

|---|---|

| Pennsylvania | 043000096 |

| New Jersey | 021202190 |

| Ohio | 044000038 |

| Virginia | 051404649 |

| West Virginia | 051404649 |

Beyond personal banking, PNC extends its expertise into numerous sectors enhancing economic growth nationwide. Their commitment to delivering exceptional value resonates deeply within communities they serve fostering enduring relationships built upon mutual respect and collaboration. Exploring diverse opportunities presented by such esteemed institutions opens doors leading toward prosperous futures filled with limitless possibilities waiting just around the corner for those willing to seize them wholeheartedly.