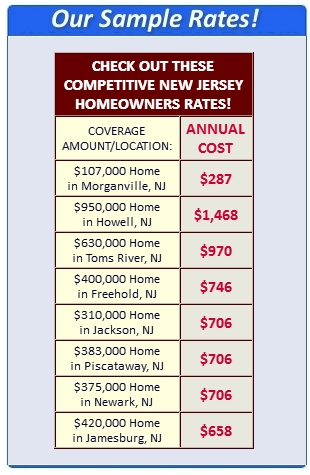

Have you ever wondered why NJM is considered one of the top choices for homeowners insurance in New Jersey and surrounding states? A bold statement supporting this query is that NJM has consistently proven its reliability, offering comprehensive coverage tailored to meet the unique needs of residents across multiple states. This reputation stems from years of dedication to customer satisfaction, competitive pricing, and an extensive range of policy options.

NJM stands out not only within New Jersey but also extends its services to neighboring regions such as Pennsylvania, Maryland, Connecticut, Ohio, and beyond. By providing robust coverage solutions for primary residences, vacation homes, and even special events like weddings, NJM ensures clients are well-protected against unforeseen circumstances. Furthermore, their commitment extends into specialized areas including flood safety measures, which often fall outside standard homeowners policies.

| Bio Data & Personal Information | Career & Professional Information |

|---|---|

| Name: NJM Insurance Group | Industry: Insurance Services |

| Founded: 1913 | Headquarters: Trenton, New Jersey |

| Location Served: NJ, PA, MD, CT, OH | Specializations: Homeowners, Auto, Business |

| Contact: NJM Website | Awards: Top-Rated Insurer by JD Power |

One key aspect setting NJM apart involves bundling opportunities designed specifically for those who own multiple properties or require additional protection during significant life milestones. For instance, newlyweds might overlook updating existing renter's agreements with details regarding engagement rings; however, incorporating these valuable items under enhanced personal property clauses becomes crucial once married life begins. Similarly, individuals planning honeymoons abroad may benefit greatly through travel-related accident waivers provided directly via supplementary add-ons attached onto basic home/auto contracts.

Additionally, while many insurers fail to address specific regional hazards adequately—such as flooding risks endemic throughout coastal zones stretching along Delaware Bay up towards Long Island Sound—NJM actively educates clientele concerning preventative strategies aimed at minimizing potential damages before they occur. Their proactive approach includes disseminating vital resources outlining best practices related to safeguarding dwellings against rising water levels caused either naturally (storms) or artificially (dam failures). Moreover, should disaster strike despite precautionary steps taken beforehand, swift claims processing guarantees affected parties receive necessary financial assistance promptly without undue delays typically associated elsewhere.

In February 2022, a homeowner residing in Montvale filed a claim after experiencing structural damage due to inclement weather conditions affecting much of northern New Jersey. Fortunately, thanks to prior arrangements made between himself and NJM representatives earlier that year, all repairs were fully covered per terms outlined within his original contract documentation. Instances like this underscore why so many continue choosing NJM over competitors when searching for dependable long-term partners capable delivering peace-of-mind amidst uncertain times.

Another compelling reason behind NJM's dominance lies within its user-friendly digital platforms allowing account holders seamless access anytime anywhere. Through secure login credentials established upon enrollment, customers gain instant visibility into billing histories, payment schedules, pending requests, and more—all accessible conveniently online 24/7. Such transparency fosters trust amongst stakeholders knowing exactly where things stand financially speaking without needing constant follow-ups via phone calls or emails.

For prospective buyers considering switching providers, understanding what makes each option better suited towards particular lifestyles proves essential prior committing resources indefinitely. With respect to auto + home bundles offered exclusively by NJM, combined savings often exceed expectations especially given added perks thrown in gratis alongside base rates quoted initially during initial consultations phases. These extras could range anywhere from discounts applicable toward safe driving habits demonstrated consistently over extended periods to reduced premiums granted automatically upon reaching certain age thresholds traditionally deemed lower-risk demographics statistically speaking.

Ultimately, selecting the right insurer depends largely upon individual preferences balanced against budget constraints imposed externally. However, armed with knowledge gleaned herein today regarding NJM's stellar track record servicing countless satisfied patrons spanning decades collectively, perhaps now seems like perfect timing exploring further possibilities opening doors wider than previously imagined possible!

| State Coverage | Policy Options | Additional Benefits |

|---|---|---|

| New Jersey | Primary Residence | Auto/Home Bundles |

| Pennsylvania | Vacation Homes | Flood Safety Tips |

| Maryland | Renter's Agreements | Travel Accident Waivers |

| Connecticut | Wedding Coverage | Secure Online Access |

| Ohio | Business Policies | Competitive Pricing |